MACHINE TOOLS RETURN TO GROWTH IN DIFFICULT 2022

The huge uncertainty has not been able to stop the robust order intake, which guarantees good production activity in 2023.

Attracting new orders and maintaining profitability will be the decisive factors in 2023.

The advanced manufacturing and machine tools sector has reached a turnover figure of 1,723.83 million euros in 2022, an increase of 9.7% on the 2021 figures. It has been a year marked by inflation, rising raw material and energy costs and huge procurement problems, which were

The advanced manufacturing and machine tools sector has reached a turnover figure of 1,723.83 million euros in 2022, an increase of 9.7% on the 2021 figures. It has been a year marked by inflation, rising raw material and energy costs and huge procurement problems, which were

by the war in Ukraine. The backlog accumulated throughout 2021 and the strong inflow recorded in 2022 itself have enabled the sector to largely overcome these setbacks.

The two main sub-sectors, starting and forming, have grown in a similar way, after several years in which forming has suffered successive declines dragged down by the paralysis of projects in the automotive sector. The recovery in the activity of car manufacturers and the demand from the energy, aeronautics, capital goods and metal-mechanics sectors in general have boosted both sub-sectors.

Exports also grew notably, by almost 10%, reaching 1,364.6 million euros, the best figure in history. Also noteworthy in exports is the almost identical growth of start-up and deformation. The main destinations for our sales abroad were: Italy, Germany, USA, France and China, followed by Mexico, Portugal and Turkey. The spectacular sales figure achieved in Italy, the highest on record, is worth highlighting, thanks to the productive investment incentive programmes promoted by the Italian government.

In the words of the president of AFM Cluster, José Pérez Berdud: “2022 has been a truly complex year. Although we started the year with a good workload, the cost structure of current orders was shaken by the price increases we had been suffering for months. In addition, the invasion of Ukraine shook the foundations of international confidence. In addition to the

human tragedy was compounded by another extraordinary increase in costs, cancellations of activity with Russia and its sphere, and great uncertainty about the future of the economy and industry. However, after the initial doubts, and against all odds, the year continued to go from strength to strength, and month by month industrial activity in various sectors and demand for manufacturing technologies has remained robust. The year closed with good activity and above our expectations in new intake, ensuring an interesting start to 2023.

ORDER INTAKE

Orders have grown by 11.28% in 2022, with a clear recovery in order intake in the deformation phase, with the start-up also maintaining a good tone. This is the best accumulated order intake in the historical series in absolute terms, which would be the second best if we deduct the effects of inflation.

Orders from abroad, also in interesting figures, grew by 13.25%. Of note is the demand received from China, Germany, USA, Mexico and Italy. Domestic orders fell slightly (-3.3%), virtually unchanged from the previous year.

Regarding the customer sectors, it is worth highlighting the recovery of investments in the automotive sector, which is strongly driving our manufacturers in the deformation subsector. The aeronautics sector has also resumed its manufacturing programmes that were paralysed due to the pandemic. Alongside them, the energy sector, metalworking in general and capital goods also offer good prospects.

Domestic consumption, our perpetual Achilles’ heel, is growing by 31.7% due to the effect of imports, although from very modest figures and less than desirable for a country that needs more and better-equipped industry.

FORECAST FOR 2023

The forecasts for the end of this year are reasonably optimistic, taking into account the interesting order books that companies in the sector have. Turnover at the end of the year is likely to grow by around 5%.

Although some of the forecasting panels that we usually handle point to a certain slowdown, it seems that this will be temporary and will be overcome with a certain degree of agility. If these forecasts come true, profitability will be the aspect to watch out for in these months. The big battle will be to produce the orders we have in our backlog, on time and efficiently, at a time when this is really complicated.

AFM Cluster CEO, Xabier Ortueta, explains: “Due to the cooling measures and inflation control, we expect a slowdown in the economy in 2023, which will most likely lead to a drop in the number of orders received. However, although we have learned that these are not good times for forecasts, our forward-looking panels limit the duration and depth of the downturn. Although cautious, we are cautiously optimistic and confident that our current portfolios and our positioning in strategic sectors such as energy, aerospace, capital goods and automotive will allow us to weather the year well. On the other hand, the need to secure supply chains and friendshoring point to new and interesting investments in equipment that we should take advantage of to continue to grow.

STRATEGIC AXES: PEOPLE, DIGITALISATION AND SUSTAINABILITY

The future of advanced manufacturing depends on successfully tackling three major challenges: attracting and nurturing the most qualified people, promoting profitable and efficient digitisation for the industry, and deepening the implementation of increasingly environmentally friendly processes that reduce our carbon footprint and that of our customers and suppliers. These are the strategic projects that the association is promoting with its member companies to ensure the competitiveness and sustainability of the sector.

The president of AFM Cluster adds: “In addition to our usual challenges related to management, innovation and internationalisation, in recent years we have been joined by three other transversal drivers for the entire industry, but which have a special impact on ours. Firstly, talent, a major factor in a highly technical, complex and competitive sector. We need to be truly active in showcasing and demonstrating the interesting range of career paths that the sector offers. We need to be attractive to young people, continue to look after our workforces and decisively incorporate women in the workshops.

In addition, digitalisation of both our products and processes must make a strong contribution to our customers’ profitability, with simple implementations and quick returns. We are talking about democratising digitisation, and for this we need the industry to understand the importance of having the data to make it possible. Finally, as a driver of sustainable energy solutions, we need to build the messages and strategies that enable us to pass on significant carbon footprint reductions to our customers.”

EMO HANNOVER 2023

This year the sector will meet in Hannover, Germany, from 18 to 23 September at the world’s leading event for advanced manufacturing technologies, the EMO trade fair. More than 50 Spanish companies will take part in the fair with a net exhibition area of more than 5,000 m2, where they will present their latest innovations and technological advances. The fair will also dedicate special areas to thematic sections on the future of connectivity, additive manufacturing, the future of sustainability in manufacturing and an open space for cobots, collaborative robots and their most innovative applications.

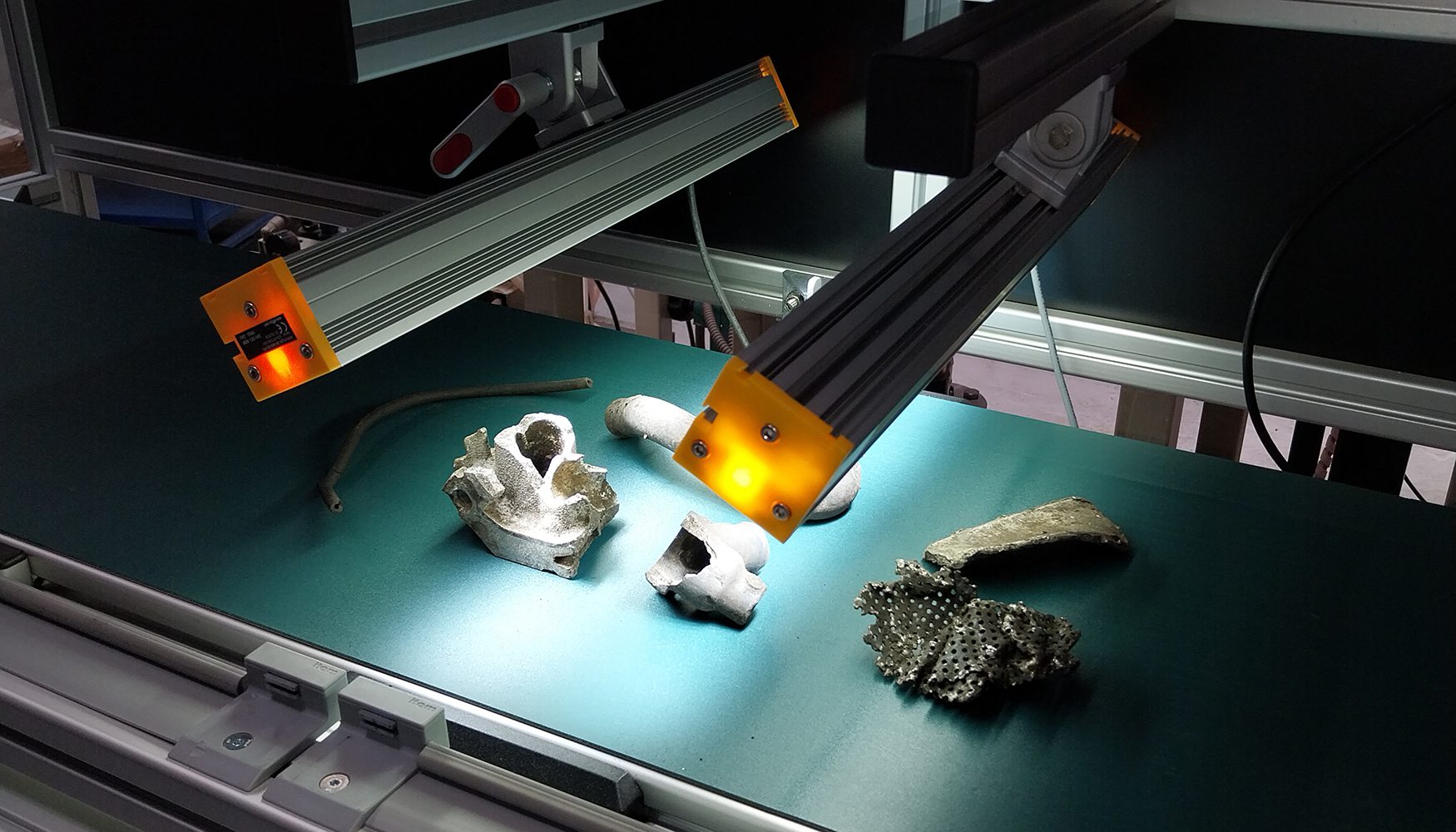

A CONSOLIDATED CLUSTER WITH MORE THAN 700 COMPANIES

With the incorporation of STECH (Smart Technologies for Advanced Manufacturing Association) in 2022, AFM Cluster completed the manufacturing value chain: manufacturers of manufacturing technologies such as machine tools and 3D printing, hand tools and machinists – who are both customers and competent suppliers of the former -, industrially-oriented start-ups and all automation and industrial digitalisation technologies, forming a fundamental substrate for the industry. More than 700 companies that make up the largest and one of the most powerful industrial conglomerates in our country.

EVENTS

5 MAY: General Assembly and Advanced Manufacturing Day, San Sebastián

25-27 MAY: ECTA CONFERENCE, San Sebastian

6-8 JUNE: +INDUSTRY Trade Fair, Bilbao

18-23 SEPTEMBER: EMO Fair, Hannover, Germany

25-27 OCTOBER: 23rd CONGRESS OF ADVANCED MANUFACTURING AND MACHINERY-HERRAMMING, San Sebastián